If you look through the high yielding stocks that are pulled up by stock screeners, you will notice that there are some outrageously high yields out there, one as high as 45%; but are they genuine high yields? You will also find that different screeners come up with different results. I discovered that when doing this screening, one of the stocks in my portfolio supposedly pays 37%. I didn't even know it paid a dividend! So let's look at the top ten yielding stocks [all of which supposedly pay over 25% yields] to see why the yield is showing up at such a high level.

Royce Focus Trust, Inc. (FUND) 45.5% This is a closed end investment company that invests in stocks and bonds of various sector companies. They pay their dividend quarterly and if you take the last four dividend payments, they add up to $1.57. If you divide that by the closing price of 10.80, you get a yield of 14.5%, still high yet far below the 45.5% the screener pulled up. The only way I could get close to the higher yield was to extrapolate out just the last payment made of $1.20 and multiply it by four to give an annual payment of $4.80. Unfortunately, you can't do that because the payments for the first three quarters of last year were 12 cents, 12 cents, and 13 cents, and its probable that the next three quarters will be around that lower amount. The dividend history shows that the first three quarters are always lower than the last quarterly payment. In addition, 91% of the distributions for last year were capital gains. Therefore, the portion of the distributions that come from ongoing dividends was minimal. You can't rely on the capital gains distributions in the future.

Cal-Bay International Inc. (CBAY.OB) 37% This is a company that invests in real estate. They have only made one dividend distribution that I could find, in April of last year. The amount of the distribution was a penny per share. So how does this generate a high yield? The stock trades at an extremely low price of 2.1 cents per share, causing the yield calculation to be so high. Since the company has only paid one dividend, you can't rely on it in the future.

Polyair Inter Pack Inc. (PPK) 37% This is another one-time-only dividend payer. The company makes protective packaging products and swimming pool products. They went ex-dividend in December 2006 at 81 cents per share.

Latin American Discovery Fund Inc. (LDF) 34.1% This is a closed-end management investment company that invests in Latin American stocks. This company has usually paid a small dividend mid-year and a large dividend at year end. Unfortunately, almost all of the company's year end distribution comes from short and long term capital gains, as opposed to dividend distributions from the stocks in the portfolio. Can't rely upon the same high distributions.

Nicholas-Applegate International & Premium Strategy Fund (NAI) 30.9% Another closed end fund with a year end distribution that includes capital gains.

Frontline Ltd. (FRO) 30.7% This company owns oil tankers which transports crude oil, coal and iron ore. They have been paying dividends since August 2001, with four distributions in 2006, five distributions in 2005, seven distributions in 2004, etc. The dividends have fluctuated all over the place from a high of $5.855 in February of 2006, and the last dividend paid of $2.50 per share. The dividends are reliant upon the company's ability to command the high fees that have been charged for transporting oil.

Templeton Emerging Markets Fund (EMF) 30.4% Yet another closed end fund with a year end distribution that includes capital gains.

Novastar Financial Inc. (NFI) 26% This mortgage company specializes in residential nonconforming loans. They have paid dividends four times a year for several years. In 2006, they paid out $5.60 per share in dividends, yet their diluted earnings per share were only $3.24. How much longer can they keep up these dividends at this level.

New Century Financial Corp. (NEW) 25.8% A mortgage real estate investment trust that has been paying dividends at least four times a year for the past several years, and dividends have increase with every payment since July 2004. In the last year, they paid out $7.30 per share. Diluted earning per share were $6.72. How much longer can they keep this up?

American Israeli Paper Mills Ltd. (AIP) 25.4% This manufacturer of paper products in Israel has paid dividends sporadically since 1997, with a couple years being skipped. Dividends have fluctuated from a low of $.685 per share to a high of $9.21 per share. Because of the substantial fluctuations of the dividends in the past, future dividends cannot be predicted.

Rules for Investing in Very High Yield Stocks

1. Check the consistency in the number of payments per year.

2. Check the consistency in the amount of the dividend from quarter to quarter.

3. Check to make sure the dividend payment doesn't include capital gains.

4. Check to make sure the yield isn't generated by a special high year-end distribution.

5. Check to make sure that the dividends don't exceed the stock's earnings per share.

6. And most important, check to make sure that your stock information provider is calculating the correct yield.

Author owns PPK.

________ Information on stocks, bonds, real estate, investments, gold, startups, & money ________

Wednesday, January 31, 2007

Odd Financial News of the Week: Businesses Support Minimum Wage Increase

Many businesses, both large and small, are now saying that increasing the minimum wage is good for business. They are saying that states that have higher minimum wages than the Federal minimum have had better employment and growth of small businesses.

Some of the executives of publicly traded companies who have signed a statement supporting higher minimum wages include:

Jim Sinegal, CEO, Costco (COST)

Arnold Hiatt, former CEO, Stride Rite (SRR)

Robert Glassman, Chairman, Wainwright Bank & Trust Co. (WAIN)

Some of the executives of publicly traded companies who have signed a statement supporting higher minimum wages include:

Jim Sinegal, CEO, Costco (COST)

Arnold Hiatt, former CEO, Stride Rite (SRR)

Robert Glassman, Chairman, Wainwright Bank & Trust Co. (WAIN)

Matsushita in the Hot Seat!

Matsushita Electric Industrial Co. Ltd. (MC), which trades on the New York Stock Exchange, has come under fire [no pun intended, really!] due to the fact that the massage chairs that they manufacture under the Panasonic brand could catch fire. Two of the chairs that were used as demos had incidents occur after they were used repeatedly. The company has recalled over 68,000 of the chairs, and said they don't think the recall would affect earnings. The stock closed up 10 cents per share.

Tuesday, January 30, 2007

Unusual Trust Stocks

The publicly traded trusts are different from regular stocks in that the earnings that are generated avoid double taxation. There is no taxation at the corporate level, only at the shareholder level. In addition, income that is distributed may be tax deferred. Most investors have heard of real estate investment trusts which invest in properties and/or mortgages, and oil & gas income trusts which receive income from gas and oil well royalties.

Oil income trusts have become so popular in Canada that the Canadian government has passed a law to end the pass through benefit in the next few years. What has happened in Canada is that other non-oil companies are jumping on the trust bandwagon. So you end up getting such stocks as a beer trust [Big Rock Brewery Income Trust (BR-UN.TO)], a trucking trust [TransForce Income Fund Trust (TIF-UN.TO)], and a "parts and service support of mobile equipment, power systems and industrial components" trust [Wajax Income Fund (WJX-UN.TO)].

Canada doesn't hold a monopoly over these trusts. There are several 'unusual' trusts that are traded in the United States, unusual being defined as non-REIT's and non-oil & gas trusts. Here are a few.

Mesabi Trust (MSB), founded in 1919, owns royalty rights in mineral properties in the United States. The Trust receives royalties based on the volume of shipments and the selling prices of iron ore pellets. Their properties are located in Louis County, Minnesota. The trust trades on the New York Stock Exchange and yields 5.2%.

Mills Music Trust (MMTRS.OB) receives payments from a deferred contingent obligation payable to Mills Music Inc. for its catalogue of over 25,000 songs of copyrighted music. Some of the more famous songs in the catalog include "Stardust", "When You're Smiling", "Sleigh Ride", "I'm Getting Sentimental Over You", "Who's Sorry Now", and "Little Drummer Boy". Other songs include those written by Bing Crosby and Duke Ellington. Paul McCartney was reported as one of the major shareholders in the past. The company has paid consecutive quarterly dividends since 1965 [over 40 years] and currently yields 4.2%. One online source has reported that the trust distributions are non-taxable until the payments exceed your cost basis, however I wouldn't rely on that info without contacting your accountant first.

Fording Canadian Coal Trust (FDG) This New York Stocks Exchange traded trust, based in Calgary, Canada, owns an interest in a partnership which produces and sells seaborne metallurgical coal that is used primarily for making coke in integrated steel mills. They have ownership interests in six open-pit coal mines. They also own wollastonite mining operations in New York and Mexico. Wollastonite is primarily used in the manufacture of automotive composites, adhesives, sealants, and many other products. The stock trades on the NYSE and pays quarterly and yields 15.1%.

Great Northern Iron Ore Properties (GNI) founded in 1906, receives income from its iron ore mineral properties in Minnesota. It trades on the NYSE and yields 11.1%.

CSS Income Trust (CCRUF.PK) provides energy and environmental waste management services. They provide waste processing, engineered landfill disposal services, terminaling and storage, completions, workovers, and abandonments. Yields 5.7%.

Macquarie Infrastructure Company Trust (MIC) owns and operates a group of infrastructure businesses, including an airport services business, an airport parking business, a district energy business, a gas production and distribution business, and a bulk liquid storage terminal business. Trades on the NYSE and yields 6.1%.

Author owns MMTRS.

Oil income trusts have become so popular in Canada that the Canadian government has passed a law to end the pass through benefit in the next few years. What has happened in Canada is that other non-oil companies are jumping on the trust bandwagon. So you end up getting such stocks as a beer trust [Big Rock Brewery Income Trust (BR-UN.TO)], a trucking trust [TransForce Income Fund Trust (TIF-UN.TO)], and a "parts and service support of mobile equipment, power systems and industrial components" trust [Wajax Income Fund (WJX-UN.TO)].

Canada doesn't hold a monopoly over these trusts. There are several 'unusual' trusts that are traded in the United States, unusual being defined as non-REIT's and non-oil & gas trusts. Here are a few.

Mesabi Trust (MSB), founded in 1919, owns royalty rights in mineral properties in the United States. The Trust receives royalties based on the volume of shipments and the selling prices of iron ore pellets. Their properties are located in Louis County, Minnesota. The trust trades on the New York Stock Exchange and yields 5.2%.

Mills Music Trust (MMTRS.OB) receives payments from a deferred contingent obligation payable to Mills Music Inc. for its catalogue of over 25,000 songs of copyrighted music. Some of the more famous songs in the catalog include "Stardust", "When You're Smiling", "Sleigh Ride", "I'm Getting Sentimental Over You", "Who's Sorry Now", and "Little Drummer Boy". Other songs include those written by Bing Crosby and Duke Ellington. Paul McCartney was reported as one of the major shareholders in the past. The company has paid consecutive quarterly dividends since 1965 [over 40 years] and currently yields 4.2%. One online source has reported that the trust distributions are non-taxable until the payments exceed your cost basis, however I wouldn't rely on that info without contacting your accountant first.

Fording Canadian Coal Trust (FDG) This New York Stocks Exchange traded trust, based in Calgary, Canada, owns an interest in a partnership which produces and sells seaborne metallurgical coal that is used primarily for making coke in integrated steel mills. They have ownership interests in six open-pit coal mines. They also own wollastonite mining operations in New York and Mexico. Wollastonite is primarily used in the manufacture of automotive composites, adhesives, sealants, and many other products. The stock trades on the NYSE and pays quarterly and yields 15.1%.

Great Northern Iron Ore Properties (GNI) founded in 1906, receives income from its iron ore mineral properties in Minnesota. It trades on the NYSE and yields 11.1%.

CSS Income Trust (CCRUF.PK) provides energy and environmental waste management services. They provide waste processing, engineered landfill disposal services, terminaling and storage, completions, workovers, and abandonments. Yields 5.7%.

Macquarie Infrastructure Company Trust (MIC) owns and operates a group of infrastructure businesses, including an airport services business, an airport parking business, a district energy business, a gas production and distribution business, and a bulk liquid storage terminal business. Trades on the NYSE and yields 6.1%.

Author owns MMTRS.

Stocks That Pay Dividends Monthly (Jan. 2007 Update)

During the last few months, I have provided articles on the stocks, including exchange-listed closed end funds [CEF's], that pay their dividends monthly. Many income investors are looking for monthly payers to support their income during retirement. Some investors want monthly dividend stocks for their IRA's for faster compounding.

This list is now up to 150 different stocks, CEF's, REIT's, floating rate funds, and oil income funds [such as Canadian royalty trusts], all of which are traded on the New York Stock Exchange or American Stock Exchange. I've added over twenty new securities since the year-end update, reposted the yields, kept the readers' recommendations of sorting by yield with the highest first, and identifying the Canadian companies [due to the tax withholding issues].

For a list of all the monthly dividend stocks in an Excel format which you can download, sort, add to, delete from, and change, go to WallStreetNewsNetwork.com.

Harvest Energy Trust (HTE) 18.4% [Canada]

BlackRock Floating Rate Inc. Strat. Fund II (FRB) 17.4%

Advantage Energy Income Fund (AAV) 17.0% [Canada]

Canetic Resources (CNE) 15.0% [Canada]

Pengrowth Energy Trust (PGH) 14.8% [Canada]

Precision Drilling (PDS) 14.2% [Canada]

PrimeWest Energy Trust (PWI) 13.6% [Canada]

BlackRock Floating Rate Inc. Strat. Fund (FRA) 13.3%

Provident Energy Trust (PVX) 11.9% [Canada]

Boulder Growth & Income Fund (BIF) 11.8%

Penn West Energy Trust (PWE) 11.8% [Canada]

Baytex Energy (BTE) 11.0% [Canada]

RMK High Income Fund Inc. (RMH) 10.9%

RMK Strategic Income Fund (RSF) 10.9%

RMK Advantage Income Fund (RMA) 10.8%

RMK Multi-Sector High Income Fund (RHY) 10.6%

Enerplus Resources Fund (ERF) 10.3% [Canada]

Enterra Energy Trust (ENT) 10.0% [Canada]

Eaton Vance CRD Opportunities (EOE) 9.7%

Nuveen Equity Premium Advantage Fund (JLA) 9.5%

Nuveen Equity Premium Opport. Fund (JSN) 9.5%

Pioneer High Income Trust (PHT) 9.4%

PIMCO High Income Fund (PHK) 9.2%

BlackRock Diversified Income Strategies (DVF) 9.1%

Nuveen Equity Premium Income Fund (JPZ) 8.9%

Calamos Convertible Opport. & Income (CHI) 8.9%

Van Kampen Senior Income Trust (VVR) 8.8%

Eaton Vance Floating-Rate Income (EFT) 8.7%

ING GL Equity Dividend (IGD) 8.7%

Lehman Brothers First Trust Income Opp. (LBC) 8.7%

Eaton Vance Senior Floating Rate Trust (EFR) 8.6%

Scudder High Income Trust (KHI) 8.6%

BlackRock Senior High Income Fund (ARK) 8.5%

Alpine Global Dynami (AGD) 8.4%

Eaton Vance Enhanced Equity Income Fund II (EOS) 8.4%

Nuveen Equity Premium Growth Fund (JPG) 8.4%

Calamos Convertible & High Income (CHY) 8.4%

Van Kampen High Income Trust II (VLT) 8.3%

First Trust/Four Corners Senior Fltg Rate Inc. (FCM) 8.1%

Nuveen Preferred Convertible Income Fund 2 (JQC) 8.1%

Western Asset High Income Fund II Inc. (HIX) 8.1%

BlackRock Enhanced Dividend Achievers Trust (BDJ) 8.0%

Eaton Vance Senior Income Trust (EVF) 8.0%

Evergreen International Balanced Income (EBI) 8.0%

United Dominion 8.5 (UDM) 8.0%

BlackRock Global Floating Rate Income (BGT) 7.9%

Pimco Global Stocksplus Income Fund (PGP) 7.9%

Strategic Global Income Fund Inc. (SGL) 7.9%

BlackRock Limited Duration Income (BLW) 7.8%

Blackrock World Investment Trust (BWC) 7.8%

Cross Timbers Royalty Trust (CRT) 7.8%

Eaton Vance Enhanced Equity Income Fund (EOI) 7.8%

Western Asset High Income Opportunity Fund (HIO) 7.8%

American Strategic Income Portfolio III (CSP) 7.7%

BlackRock Enhanced Government Fund, Inc. (EGF) 7.5%

Franklin Templeton Ltd. Duration Income Trust (FTF) 7.5%

Advent Claymore Convertible Secur. & Income (AVK) 7.4%

Nuveen Real Estate Income Fund (JRS) 7.4%

BlackRock Preferred and Corporate Inc. Strat. (PSW) 7.4%

Western Asset Global High Income Fund Inc. (EHI) 7.3%

ACM Income Fund Inc. (ACG) 7.3%

40/86 Strategic Income Fund (CFD) 7.2%

Scudder Multi-Market Income Trust (KMM) 7.1%

Gabelli Gold, Natural Resources & Income (GGN) 7.0%

ING Clarion Real Estate Income Fund (IIA) 7.0%

Scudder Strategic Income Trust (KST) 7.0%

ACM Managed Dollar Income Fund (ADF) 7.0%

ACM Government Opportunity Fund Inc. (AOF) 6.9%

Alliance World Dollar Government Fund II (AWF) 6.9%

Morgan Stanley Municipal Premium Income (PIA) 6.9%

Permian Basin Royalty Trust (PBT) 6.8%

RMR Real Estate Fund (RMR) 6.8%

Morgan Stanley Quality Municipal Income Trust (IQI) 6.7%

BlackRock Preferred Income Strategies (PSY) 6.7%

Aberdeen Asia-Pacific Income Fund Inc. (FAX) 6.6%

AIM Select Real Estate Income Fund (RRE) 6.5%

San Juan Basin Royalty Trust (SJT) 6.5%

Colonial Intermarket Income Trust 1 (CMK) 6.4%

Flaherty & Crumrine Preferred Income Opp. (PFO) 6.4%

Neuberger Berman Real Estate Securities Inc. (NRO) 6.4%

Van Kampen Income Trust (VIN) 6.4%

RMR Hospitality and Real Estate Fund (RHR) 6.3%

BlackRock Income Opportunity Trust, Inc. (BNA) 6.2%

Scudder RREEF Real Estate Fund II, Inc. (SRO) 6.2%

American Income Fund Inc. (MRF) 6.2%

AEW Real Estate Income Fund (RIF) 6.1%

AmREIT (AMY) 6.1%

BlackRock Income Trust, Inc. (BKT) 6.1%

Gabelli Dividend & Income Trust (GDV) 6.0%

ING Clarion Global Real Estate Income Fund (IGR) 6.0%

Scudder RREEF Real Estate Fund Inc. (SRQ) 6.0%

Aberdeen Global Income Fund (FCO) 6.0%

MFS Multimarket Income Trust (MMT) 5.9%

BlackRock Municipal Income Trust (BFK) 5.8%

Gabelli Global Utility & Income Trust (GLU) 5.8%

Hugoton Royalty Trust (HGT) 5.8%

Morgan Stanley Insured Municipal Income (IIM) 5.8%

BlackRock Municipal Income Trust II (BLE) 5.7%

Morgan Stanley Municipal Income Opportunities (OIA) 5.7%

Real Estate Income Fund Inc. (RIT) 5.7%

Putnam Master Intermediate Income Trust (PIM) 5.6%

Putnam Premier Income Trust (PPT) 5.6%

Colonial Municipal Income Trust (CMU) 5.5%

Dreyfus Strategic Municipals Inc. (LEO) 5.5%

MFS Charter Income Trust (MCR) 5.5%

MFS Municipal Income Trust (MFM) 5.5%

Morgan Stanley Municipal Inc. Opp. Trust II (OIB) 5.5%

Realty Income Corp. (O) 5.5%

BlackRock California Municipal Income Trust (BFZ) 5.4%

BlackRock Florida Municipal Income Trust (BBF) 5.4%

Colonial High Income Municipal Trust (CXE) 5.4%

Morgan Stanley Municipal Inc. Opp. Trust III (OIC) 5.4%

Pioneer Municipal High Inc. Advantage Trust (MAV) 5.4%

Scudder Strategic Municipal Income Trust (KSM) 5.4%

BlackRock New York Municipal Income Trust (BNY) 5.3%

MFS Government Markets Income Trust (MGF) 5.3%

Putnam Managed Municipal Income Trust (PMM) 5.3%

BlackRock New Jersey Municipal Income Trust (BNJ) 5.2%

MFS Intermediate Income Trust (MIN) 5.2%

Pioneer Muncipal High Income Trust (MHI) 5.2%

Sabine Royalty Trust (SBR) 5.2%

Alliance National Municipal Income (AFB) 5.2%

BlackRock California Municipal Income Trust II (BCL) 5.1%

Morgan Stanley California Insured Muni Inc. (IIC) 5.1%

BlackRock Florida Insured Municipal Income (BAF) 5.0%

Eaton Vance Municipal Income Trust (EVN) 5.0%

Inland Real Estate Corp. (IRC) 5.0%

Van Kampen Advantage Municipal Inc. Trust II (VKI) 5.0%

Van Kampen California Value Municipal Income (VCV) 5.0%

ACM Municipal Securities Income Fund (AMU) 5.0%

BlackRock Insured Municipal Income Trust (BYM) 4.9%

ACM Managed Income Fund Inc (AMF) 4.9%

Alliance California Municipal Income (AKP) 4.9%

Alliance New York Municipal Income (AYN) 4.9%

BlackRock New York Municipal Income Trust II (BFY) 4.8%

Eaton Vance Pennsylvania Municipal Income (EVP) 4.8%

BlackRock California Insured Municipal Income (BCK) 4.7%

BlackRock New York Insured Municipal Income (BSE) 4.7%

Eaton Vance Florida Municipal Income Trust (FEV) 4.7%

Eaton Vance Michigan Municipal Income Trust (EMI) 4.7%

Eaton Vance New York Municipal Income Trust (EVY) 4.7%

Eaton Vance Ohio Municipal Income Trust (EVO) 4.7%

Neuberger Berman Real Estate Income Fund (NRL) 4.7%

Van Kampen Massachusetts Value Muni Inc. (VMV) 4.7%

Eaton Vance California Municipal Income Trust (CEV) 4.5%

Eaton Vance New Jersey Municipal Inc. Trust (EVJ) 4.5%

Morgan Stanley Government Income Trust (GVT) 4.4%

Scudder Municipal Income Trust (KTF) 4.4%

Eaton Vance Massachusetts Municipal Income (MMV) 4.3%

Mesa Royalty Trust (MTR) 2.2%

Author owns PWE and PWI.

This list is now up to 150 different stocks, CEF's, REIT's, floating rate funds, and oil income funds [such as Canadian royalty trusts], all of which are traded on the New York Stock Exchange or American Stock Exchange. I've added over twenty new securities since the year-end update, reposted the yields, kept the readers' recommendations of sorting by yield with the highest first, and identifying the Canadian companies [due to the tax withholding issues].

For a list of all the monthly dividend stocks in an Excel format which you can download, sort, add to, delete from, and change, go to WallStreetNewsNetwork.com.

Harvest Energy Trust (HTE) 18.4% [Canada]

BlackRock Floating Rate Inc. Strat. Fund II (FRB) 17.4%

Advantage Energy Income Fund (AAV) 17.0% [Canada]

Canetic Resources (CNE) 15.0% [Canada]

Pengrowth Energy Trust (PGH) 14.8% [Canada]

Precision Drilling (PDS) 14.2% [Canada]

PrimeWest Energy Trust (PWI) 13.6% [Canada]

BlackRock Floating Rate Inc. Strat. Fund (FRA) 13.3%

Provident Energy Trust (PVX) 11.9% [Canada]

Boulder Growth & Income Fund (BIF) 11.8%

Penn West Energy Trust (PWE) 11.8% [Canada]

Baytex Energy (BTE) 11.0% [Canada]

RMK High Income Fund Inc. (RMH) 10.9%

RMK Strategic Income Fund (RSF) 10.9%

RMK Advantage Income Fund (RMA) 10.8%

RMK Multi-Sector High Income Fund (RHY) 10.6%

Enerplus Resources Fund (ERF) 10.3% [Canada]

Enterra Energy Trust (ENT) 10.0% [Canada]

Eaton Vance CRD Opportunities (EOE) 9.7%

Nuveen Equity Premium Advantage Fund (JLA) 9.5%

Nuveen Equity Premium Opport. Fund (JSN) 9.5%

Pioneer High Income Trust (PHT) 9.4%

PIMCO High Income Fund (PHK) 9.2%

BlackRock Diversified Income Strategies (DVF) 9.1%

Nuveen Equity Premium Income Fund (JPZ) 8.9%

Calamos Convertible Opport. & Income (CHI) 8.9%

Van Kampen Senior Income Trust (VVR) 8.8%

Eaton Vance Floating-Rate Income (EFT) 8.7%

ING GL Equity Dividend (IGD) 8.7%

Lehman Brothers First Trust Income Opp. (LBC) 8.7%

Eaton Vance Senior Floating Rate Trust (EFR) 8.6%

Scudder High Income Trust (KHI) 8.6%

BlackRock Senior High Income Fund (ARK) 8.5%

Alpine Global Dynami (AGD) 8.4%

Eaton Vance Enhanced Equity Income Fund II (EOS) 8.4%

Nuveen Equity Premium Growth Fund (JPG) 8.4%

Calamos Convertible & High Income (CHY) 8.4%

Van Kampen High Income Trust II (VLT) 8.3%

First Trust/Four Corners Senior Fltg Rate Inc. (FCM) 8.1%

Nuveen Preferred Convertible Income Fund 2 (JQC) 8.1%

Western Asset High Income Fund II Inc. (HIX) 8.1%

BlackRock Enhanced Dividend Achievers Trust (BDJ) 8.0%

Eaton Vance Senior Income Trust (EVF) 8.0%

Evergreen International Balanced Income (EBI) 8.0%

United Dominion 8.5 (UDM) 8.0%

BlackRock Global Floating Rate Income (BGT) 7.9%

Pimco Global Stocksplus Income Fund (PGP) 7.9%

Strategic Global Income Fund Inc. (SGL) 7.9%

BlackRock Limited Duration Income (BLW) 7.8%

Blackrock World Investment Trust (BWC) 7.8%

Cross Timbers Royalty Trust (CRT) 7.8%

Eaton Vance Enhanced Equity Income Fund (EOI) 7.8%

Western Asset High Income Opportunity Fund (HIO) 7.8%

American Strategic Income Portfolio III (CSP) 7.7%

BlackRock Enhanced Government Fund, Inc. (EGF) 7.5%

Franklin Templeton Ltd. Duration Income Trust (FTF) 7.5%

Advent Claymore Convertible Secur. & Income (AVK) 7.4%

Nuveen Real Estate Income Fund (JRS) 7.4%

BlackRock Preferred and Corporate Inc. Strat. (PSW) 7.4%

Western Asset Global High Income Fund Inc. (EHI) 7.3%

ACM Income Fund Inc. (ACG) 7.3%

40/86 Strategic Income Fund (CFD) 7.2%

Scudder Multi-Market Income Trust (KMM) 7.1%

Gabelli Gold, Natural Resources & Income (GGN) 7.0%

ING Clarion Real Estate Income Fund (IIA) 7.0%

Scudder Strategic Income Trust (KST) 7.0%

ACM Managed Dollar Income Fund (ADF) 7.0%

ACM Government Opportunity Fund Inc. (AOF) 6.9%

Alliance World Dollar Government Fund II (AWF) 6.9%

Morgan Stanley Municipal Premium Income (PIA) 6.9%

Permian Basin Royalty Trust (PBT) 6.8%

RMR Real Estate Fund (RMR) 6.8%

Morgan Stanley Quality Municipal Income Trust (IQI) 6.7%

BlackRock Preferred Income Strategies (PSY) 6.7%

Aberdeen Asia-Pacific Income Fund Inc. (FAX) 6.6%

AIM Select Real Estate Income Fund (RRE) 6.5%

San Juan Basin Royalty Trust (SJT) 6.5%

Colonial Intermarket Income Trust 1 (CMK) 6.4%

Flaherty & Crumrine Preferred Income Opp. (PFO) 6.4%

Neuberger Berman Real Estate Securities Inc. (NRO) 6.4%

Van Kampen Income Trust (VIN) 6.4%

RMR Hospitality and Real Estate Fund (RHR) 6.3%

BlackRock Income Opportunity Trust, Inc. (BNA) 6.2%

Scudder RREEF Real Estate Fund II, Inc. (SRO) 6.2%

American Income Fund Inc. (MRF) 6.2%

AEW Real Estate Income Fund (RIF) 6.1%

AmREIT (AMY) 6.1%

BlackRock Income Trust, Inc. (BKT) 6.1%

Gabelli Dividend & Income Trust (GDV) 6.0%

ING Clarion Global Real Estate Income Fund (IGR) 6.0%

Scudder RREEF Real Estate Fund Inc. (SRQ) 6.0%

Aberdeen Global Income Fund (FCO) 6.0%

MFS Multimarket Income Trust (MMT) 5.9%

BlackRock Municipal Income Trust (BFK) 5.8%

Gabelli Global Utility & Income Trust (GLU) 5.8%

Hugoton Royalty Trust (HGT) 5.8%

Morgan Stanley Insured Municipal Income (IIM) 5.8%

BlackRock Municipal Income Trust II (BLE) 5.7%

Morgan Stanley Municipal Income Opportunities (OIA) 5.7%

Real Estate Income Fund Inc. (RIT) 5.7%

Putnam Master Intermediate Income Trust (PIM) 5.6%

Putnam Premier Income Trust (PPT) 5.6%

Colonial Municipal Income Trust (CMU) 5.5%

Dreyfus Strategic Municipals Inc. (LEO) 5.5%

MFS Charter Income Trust (MCR) 5.5%

MFS Municipal Income Trust (MFM) 5.5%

Morgan Stanley Municipal Inc. Opp. Trust II (OIB) 5.5%

Realty Income Corp. (O) 5.5%

BlackRock California Municipal Income Trust (BFZ) 5.4%

BlackRock Florida Municipal Income Trust (BBF) 5.4%

Colonial High Income Municipal Trust (CXE) 5.4%

Morgan Stanley Municipal Inc. Opp. Trust III (OIC) 5.4%

Pioneer Municipal High Inc. Advantage Trust (MAV) 5.4%

Scudder Strategic Municipal Income Trust (KSM) 5.4%

BlackRock New York Municipal Income Trust (BNY) 5.3%

MFS Government Markets Income Trust (MGF) 5.3%

Putnam Managed Municipal Income Trust (PMM) 5.3%

BlackRock New Jersey Municipal Income Trust (BNJ) 5.2%

MFS Intermediate Income Trust (MIN) 5.2%

Pioneer Muncipal High Income Trust (MHI) 5.2%

Sabine Royalty Trust (SBR) 5.2%

Alliance National Municipal Income (AFB) 5.2%

BlackRock California Municipal Income Trust II (BCL) 5.1%

Morgan Stanley California Insured Muni Inc. (IIC) 5.1%

BlackRock Florida Insured Municipal Income (BAF) 5.0%

Eaton Vance Municipal Income Trust (EVN) 5.0%

Inland Real Estate Corp. (IRC) 5.0%

Van Kampen Advantage Municipal Inc. Trust II (VKI) 5.0%

Van Kampen California Value Municipal Income (VCV) 5.0%

ACM Municipal Securities Income Fund (AMU) 5.0%

BlackRock Insured Municipal Income Trust (BYM) 4.9%

ACM Managed Income Fund Inc (AMF) 4.9%

Alliance California Municipal Income (AKP) 4.9%

Alliance New York Municipal Income (AYN) 4.9%

BlackRock New York Municipal Income Trust II (BFY) 4.8%

Eaton Vance Pennsylvania Municipal Income (EVP) 4.8%

BlackRock California Insured Municipal Income (BCK) 4.7%

BlackRock New York Insured Municipal Income (BSE) 4.7%

Eaton Vance Florida Municipal Income Trust (FEV) 4.7%

Eaton Vance Michigan Municipal Income Trust (EMI) 4.7%

Eaton Vance New York Municipal Income Trust (EVY) 4.7%

Eaton Vance Ohio Municipal Income Trust (EVO) 4.7%

Neuberger Berman Real Estate Income Fund (NRL) 4.7%

Van Kampen Massachusetts Value Muni Inc. (VMV) 4.7%

Eaton Vance California Municipal Income Trust (CEV) 4.5%

Eaton Vance New Jersey Municipal Inc. Trust (EVJ) 4.5%

Morgan Stanley Government Income Trust (GVT) 4.4%

Scudder Municipal Income Trust (KTF) 4.4%

Eaton Vance Massachusetts Municipal Income (MMV) 4.3%

Mesa Royalty Trust (MTR) 2.2%

Author owns PWE and PWI.

Monday, January 29, 2007

Four Reasons Why Google Could Drop

A Korean blog called OhMyNews.com has listed four major reasons why the Google (GOOG) stock could drop in value, including security issues, a potential merger between Microsoft (MSFT) and (YHOO), becoming "uncool", and consumers preference for humanization of search engines.

Author owns GOOG, YHOO, and MSFT.

Author owns GOOG, YHOO, and MSFT.

House for Sale: $155 Million

The most expensive house in the world will be built at the Yellowstone Club, a resort near Bozeman, Montana by Tim Blixseth, a real estate and timber tycoon. The house will be 53,000 square feet on 160 acres with 10 bedrooms.

The second most expensive mansion is Updown Court in Windlesham, England at $139 million. In third place is Donald Trump's house in Palm Beach, Florida at $125 million.

The second most expensive mansion is Updown Court in Windlesham, England at $139 million. In third place is Donald Trump's house in Palm Beach, Florida at $125 million.

Short Interest Numbers Out

Short positions of stocks is required to be reported on the 15th or the month or earlier if the 15th falls on a Saturday, Sunday or holiday. The compilation is done within eight days. NASDAQ provides a nice database on short positions, even on New York Stock Exchange Stocks. [That's very nice of them.] If you look at the change in the short interest from December 15 to January 12 for some of the more active stocks, you will see some interesting data:

Intel (INTC) down 2.8%

Ford (F) up 20.7%

Cisco (CSCO) up 1.8%

Motorola (MOT) up 11%

Bristol-Myers Squibb (BMY) down 18.7%

Pfizer (PFE) down 12.4%

Oracle (ORCL) up 11.6%

Author currently does not own any of the above.

Intel (INTC) down 2.8%

Ford (F) up 20.7%

Cisco (CSCO) up 1.8%

Motorola (MOT) up 11%

Bristol-Myers Squibb (BMY) down 18.7%

Pfizer (PFE) down 12.4%

Oracle (ORCL) up 11.6%

Author currently does not own any of the above.

Is a Stock Symbol Just Symbolic or Does It Add Value?

If you have been reading Stockerblog for several months, you have noticed that I have occasionally included stock market stock symbol trivia, where I ask what you think the company is that has a certain stock symbol, such as TAP, FUEL, CAKE, FACE, XRAY, SEED, PILL, etc.

But is having an interesting name, just that, interesting? Or is it possible value can be added to the stock by having a great stock symbol. Let's look at one example which is interesting trivia in itself.

For many years, the stock symbol for Harley Davidson (HOG) was HDI. However on August 15, 2006, the company changed its symbol to HOG, which is a term that is closely associated with Harley, and is also the abbreviation for the Harley Owners Group. If we look t the performance of the stock for the five month previous to the symbol change from May 15 to August 15, the stock was up only 14.7%; however for the five months subsequent to the stock symbol change, the stock was up 28.3%, almost double the return.

Author owns HOG.

But is having an interesting name, just that, interesting? Or is it possible value can be added to the stock by having a great stock symbol. Let's look at one example which is interesting trivia in itself.

For many years, the stock symbol for Harley Davidson (HOG) was HDI. However on August 15, 2006, the company changed its symbol to HOG, which is a term that is closely associated with Harley, and is also the abbreviation for the Harley Owners Group. If we look t the performance of the stock for the five month previous to the symbol change from May 15 to August 15, the stock was up only 14.7%; however for the five months subsequent to the stock symbol change, the stock was up 28.3%, almost double the return.

Author owns HOG.

Top Selling Wall Street and Stock Market Domain Names

There is a website called dnsaleprice.com which provides a database of sales of domain names, and shows the sales price, the sales date, and who handled the sale. It allows you to search by keywords.

The two highest with the keyword 'stock' were StockQuotes.mobi and StockTickers.com, which sold for $27,000 each, both of which sold in October of last year. WallStreet.com was sold for $1,030,000 in May of 1999. The top domain with the word 'investment' was ForeignInvestments.com, which sold for $8,000. Interestingly, a typo domain, at least it looks like a typo domain to me, InvestmentFonds.info, sold for $5,673. The top two sales for domains with 'bonds' as a keyword were JunkBonds.com at $8,090 and BondPrice.com at $5,100.

The two highest with the keyword 'stock' were StockQuotes.mobi and StockTickers.com, which sold for $27,000 each, both of which sold in October of last year. WallStreet.com was sold for $1,030,000 in May of 1999. The top domain with the word 'investment' was ForeignInvestments.com, which sold for $8,000. Interestingly, a typo domain, at least it looks like a typo domain to me, InvestmentFonds.info, sold for $5,673. The top two sales for domains with 'bonds' as a keyword were JunkBonds.com at $8,090 and BondPrice.com at $5,100.

Highest Yielding Soft Drink Stocks

On January 25, the Board of Directors for Coca-Cola Bottling Co. Consolidated (COKE) declared a dividend for the first quarter of 2007 of $.25 per share. The company’s dividends have been paid every quarter since 1990. Many of the non-alcoholic beverage company stocks pay dividends, a couple of which pay a yield of over 2%. Most have been consistent dividend payers for many years. Here are the top soft drink dividend payers, sorted by yield.

Coca Cola (KO) 2.6% One of the largest manufacturers, distributors, and marketers of nonalcoholic beverage concentrates and syrups in the world.

PepsiAmericas Inc. (PAS) 2.3% Pepsi, Diet Pepsi, and Mountain Dew. Distributes in United States, Central Europe, and the Caribbean.

Cadbury Schweppes Plc. (CSG) 2.1% Dr.Pepper, Schweppes, 7 Up, Snapple, Mott's, Hawaiian Punch, Clamato, and Schweppes Tonic Water. Founded in 1783.

Pepsico, Inc. (PEP) 1.9% Manufacturer of Mountain Dew, Diet Pepsi, Gatorade, Tropicana Pure Premium, Aquafina water, Sierra Mist, Mug, Tropicana juice drinks, Propel, SoBe, Slice, Dole, Tropicana Twister, and Tropicana Season’s Best.

Coca-Cola Bottling Co. Consolidated (COKE) 1.5% distributes and markets carbonated and noncarbonated beverages, primarily of The Coca-Cola Company. Distributes in North Carolina, South Carolina, West Virginia, Alabama, Mississippi, Tennessee, Kentucky, Virginia, Pennsylvania, Georgia, and Florida.

Pepsi Bottling Group (PBG) 1.4% Bottler of Pepsi-Cola, Diet Pepsi, Mountain Dew, Aquafina, Lipton Brisk, Sierra Mist, Diet Mountain Dew, Tropicana Juice Drinks, SoBe, and Starbucks Frappuccino. Distributes in United States, Canada, Spain, Greece, Russia, Turkey, and Mexico.

Coca Cola Enterprises (CCE) 1.2% Coca-Cola classic, Diet Coke, Sprite, Dasani, Fanta, Schweppes, and caffeine free Diet Coke. Distributes in North America, Great Britain, France, Belgium, the Netherlands, Luxembourg, and Monaco.

Coca-Cola Hellen ADS (CCH) 1% Athens, Greece based company. Distributor of Coca Cola products in Europe.

Embotell Andina SA (AKO-A) 1% Santiago, Chile based company. Distributor of Coca-Cola products in Chile, Brazil, and Argentina.

Coca Cola Femsa SA (KOF) .8% Distributor of Coca Cola products in Mexico, Central America, Colombia, Venezuela, Argentina, and Brazil.

Author owns KO and KOF.

Coca Cola (KO) 2.6% One of the largest manufacturers, distributors, and marketers of nonalcoholic beverage concentrates and syrups in the world.

PepsiAmericas Inc. (PAS) 2.3% Pepsi, Diet Pepsi, and Mountain Dew. Distributes in United States, Central Europe, and the Caribbean.

Cadbury Schweppes Plc. (CSG) 2.1% Dr.Pepper, Schweppes, 7 Up, Snapple, Mott's, Hawaiian Punch, Clamato, and Schweppes Tonic Water. Founded in 1783.

Pepsico, Inc. (PEP) 1.9% Manufacturer of Mountain Dew, Diet Pepsi, Gatorade, Tropicana Pure Premium, Aquafina water, Sierra Mist, Mug, Tropicana juice drinks, Propel, SoBe, Slice, Dole, Tropicana Twister, and Tropicana Season’s Best.

Coca-Cola Bottling Co. Consolidated (COKE) 1.5% distributes and markets carbonated and noncarbonated beverages, primarily of The Coca-Cola Company. Distributes in North Carolina, South Carolina, West Virginia, Alabama, Mississippi, Tennessee, Kentucky, Virginia, Pennsylvania, Georgia, and Florida.

Pepsi Bottling Group (PBG) 1.4% Bottler of Pepsi-Cola, Diet Pepsi, Mountain Dew, Aquafina, Lipton Brisk, Sierra Mist, Diet Mountain Dew, Tropicana Juice Drinks, SoBe, and Starbucks Frappuccino. Distributes in United States, Canada, Spain, Greece, Russia, Turkey, and Mexico.

Coca Cola Enterprises (CCE) 1.2% Coca-Cola classic, Diet Coke, Sprite, Dasani, Fanta, Schweppes, and caffeine free Diet Coke. Distributes in North America, Great Britain, France, Belgium, the Netherlands, Luxembourg, and Monaco.

Coca-Cola Hellen ADS (CCH) 1% Athens, Greece based company. Distributor of Coca Cola products in Europe.

Embotell Andina SA (AKO-A) 1% Santiago, Chile based company. Distributor of Coca-Cola products in Chile, Brazil, and Argentina.

Coca Cola Femsa SA (KOF) .8% Distributor of Coca Cola products in Mexico, Central America, Colombia, Venezuela, Argentina, and Brazil.

Author owns KO and KOF.

Sunday, January 28, 2007

Geothermal Stocks Heating Up

In previous articles, I've written about several types of alternative energy stocks, including solar energy stocks, wind energy stocks, ethanol stocks and flywheel stocks. Today I'm writing about an alternative energy that hasn't received much press coverage: geothermal stocks. Geothermal generation utilizes natural underground heat sources to powering a turbine which drives a generator. Geothermal comes from the Greek words geo, which means earth, and therme, meaning heat. The litertranslationion of geothermal is "earth heat". And as it turns out, several of these geothermal stocks are heating up.

Calpine Corporation (CPNLQ.PK) Founded in 1984, this San Jose based company provides electricity in the United States and Canada through the ownership and operation of its own power generation plants. They own 19 geothermal power plants at The Geysers in California.

Constellation Energy Group (CEG). This 1906 electrical generating company owns and operates generating plants and fuel processing facilities utilizing various types of fuel including nuclear, coal, natural gas, oil, solar, geothermal, hydro and biomass. Yield is 2.1%.

IdaCorp, Inc. (IDA) This holding company owns Idaho Power Company (IPC), which is involved in the generation, transmission, distribution, and sale of electric energy primarily in southern Idaho and eastern Oregon. Their electrical generation comes from hydroelectric, natural gas, diesel, coal, and geothermal plants. The stock yields 3.3%.

Nevada Geothermal Power, Inc. (NGLPF.OB) This company explores for and develops geothermal projects in the United States to provide electrical. They own a 100% leasehold interest in the Blue Mountain, Pumpernickel, Black Warrior projects in Nevada and the Crump Geyser Project in southern Oregon.

Ormat Technologies Inc. (NYSE: ORA) This Nevada based company traded on the New York Stock Exchange and founded in 1965, owns, and operates geothermal power plants, selling electricity in the United States, Guatemala, Kenya, Nicaragua, and the Philippines. They also provide products and services to other geothermal power generators.

PG & E Corp. (PCG) This California-based electric and gas utility serves 5 million customers. Their electrical generation comes from natural gas, nuclear, hydro, coal, geothermal, wind, and several other types of renewable sources. Yields 2.9%.

Polaris Geothermal (PGTHF.PK) The company is a developer of renewable energy in Latin America. They are currently developing a 66 MW geothermal project on its San Jacinto Tizate concession in Nicaragua.

Raser Technologies (RZ) This Utah based company traded on the New York Stock Exchange Arca exchange, and founded in 2003, develops high performance electric motor and controller technology. In addition, it has secured geothermal rights to certain Nevada properties owned by Truckee River Ranches, LLC, under the terms of a 50-year lease agreement.

Sierra Geothermal Power Corp (SRAGF.PK) – Sierra Geothermal is a developer of renewable power from geothermal sources. The have investments in 15 geothermal projects located in Nevada and California. Sierra has also recently completed an approximate $5 million private placement.

US Geothermal Inc. (UGTH.OB) This Boise based company, founded in 2002, is involved in the development of geothermal energy power plants in the Raft River area of Idaho.

Western GeoPower Corp (WGPWF.PK) The company develops geothermal energy projects. They own the Unit 15 Steam Field located in The Geyser Geothermal Field in California, United States and in the South Meager Geothermal Project in British Columbia, Canada.

WFI Industries (WFILF.PK) This Fort Wayne, Indiana company is development and manufacture of geothermal heating and cooling systems, for both residential and commercial customers. The company has paid quarterly dividends since September 2003, and currently yields 2.2%. The stock is up over 60% during the last year.

Author does not own any of the above at this time.

Calpine Corporation (CPNLQ.PK) Founded in 1984, this San Jose based company provides electricity in the United States and Canada through the ownership and operation of its own power generation plants. They own 19 geothermal power plants at The Geysers in California.

Constellation Energy Group (CEG). This 1906 electrical generating company owns and operates generating plants and fuel processing facilities utilizing various types of fuel including nuclear, coal, natural gas, oil, solar, geothermal, hydro and biomass. Yield is 2.1%.

IdaCorp, Inc. (IDA) This holding company owns Idaho Power Company (IPC), which is involved in the generation, transmission, distribution, and sale of electric energy primarily in southern Idaho and eastern Oregon. Their electrical generation comes from hydroelectric, natural gas, diesel, coal, and geothermal plants. The stock yields 3.3%.

Nevada Geothermal Power, Inc. (NGLPF.OB) This company explores for and develops geothermal projects in the United States to provide electrical. They own a 100% leasehold interest in the Blue Mountain, Pumpernickel, Black Warrior projects in Nevada and the Crump Geyser Project in southern Oregon.

Ormat Technologies Inc. (NYSE: ORA) This Nevada based company traded on the New York Stock Exchange and founded in 1965, owns, and operates geothermal power plants, selling electricity in the United States, Guatemala, Kenya, Nicaragua, and the Philippines. They also provide products and services to other geothermal power generators.

PG & E Corp. (PCG) This California-based electric and gas utility serves 5 million customers. Their electrical generation comes from natural gas, nuclear, hydro, coal, geothermal, wind, and several other types of renewable sources. Yields 2.9%.

Polaris Geothermal (PGTHF.PK) The company is a developer of renewable energy in Latin America. They are currently developing a 66 MW geothermal project on its San Jacinto Tizate concession in Nicaragua.

Raser Technologies (RZ) This Utah based company traded on the New York Stock Exchange Arca exchange, and founded in 2003, develops high performance electric motor and controller technology. In addition, it has secured geothermal rights to certain Nevada properties owned by Truckee River Ranches, LLC, under the terms of a 50-year lease agreement.

Sierra Geothermal Power Corp (SRAGF.PK) – Sierra Geothermal is a developer of renewable power from geothermal sources. The have investments in 15 geothermal projects located in Nevada and California. Sierra has also recently completed an approximate $5 million private placement.

US Geothermal Inc. (UGTH.OB) This Boise based company, founded in 2002, is involved in the development of geothermal energy power plants in the Raft River area of Idaho.

Western GeoPower Corp (WGPWF.PK) The company develops geothermal energy projects. They own the Unit 15 Steam Field located in The Geyser Geothermal Field in California, United States and in the South Meager Geothermal Project in British Columbia, Canada.

WFI Industries (WFILF.PK) This Fort Wayne, Indiana company is development and manufacture of geothermal heating and cooling systems, for both residential and commercial customers. The company has paid quarterly dividends since September 2003, and currently yields 2.2%. The stock is up over 60% during the last year.

Author does not own any of the above at this time.

Wednesday, January 24, 2007

Top Gainers on the NYSE

Everyone has been focusing on the large NASDAQ gains on Wednesday, January 24, but the New York Stock Exchange has also done quite well, up about 88 points for the day over a previously strong day on Tuesday. The largest gainers by percentage gain on the NYSE for Wednesday are as follows:

Transdigm Group (TDG) 12.4% aircraft components

Corning (GLW) 10.9% display technology

A V X Corp. (AVX) 9.8% electronic components

Salton Inc. (SFP) 9.3% small appliances and personal care products

Hancock Fabric (HKF)8.4% fabric and sewing accessories

Author does not own any of the above.

Transdigm Group (TDG) 12.4% aircraft components

Corning (GLW) 10.9% display technology

A V X Corp. (AVX) 9.8% electronic components

Salton Inc. (SFP) 9.3% small appliances and personal care products

Hancock Fabric (HKF)8.4% fabric and sewing accessories

Author does not own any of the above.

Seven Companies Announce Stock Buybacks Today

When a company has a buyback, it means that the company is going out and buying shares of their own company on the open market. This is generally very bullish for stocks, since it shows confidence by executives in their own companies, it reduces the number of shares outstanding making them scarcer [scarcity causes price increases], and it means that the earnings and dividends are split up among fewer shares, benefiting the remaining shareholders. An article in TheStreet.com lists all the buybacks that were announced for the last month and a half. Here are the announcements today [January 24]:

Bank of America (BAC)

Cypress Semiconductor (CY)

East West Bancorp (EWBC)

eBay (EBAY)

FreightCar America (RAIL)

Rome Bancorp (ROME)

Varian (VARI)

Author owns EBAY.

Bank of America (BAC)

Cypress Semiconductor (CY)

East West Bancorp (EWBC)

eBay (EBAY)

FreightCar America (RAIL)

Rome Bancorp (ROME)

Varian (VARI)

Author owns EBAY.

eBay has more Business in Britain than any other Country

You are probably already aware that eBay (EBAY) was up about 18% today [January 24] including after-market trading, but what you probably didn't know is that eBay gets more business per capita from Britain than any other country in the world, including the U.S. Approximately $98 per year is traded per person per year on eBay in the United Kingdom.

Author owns EBAY.

Author owns EBAY.

400% Return! Minimum Investment: One Penny

Did everyone pay attention when I wrote the article last month about the melting value of pennies being worth more than the face value of the penny. The government was so concerned that they also put a restriction on the export of the coins.

Now the Fed is talking about 'rebasing' the penny, by changing the value of it from one cent to five cents. Hoarders are already stockpiling pennies as a speculation. If this proposal goes through, that would be a pretty substantial return on a one cent investment.

Now the Fed is talking about 'rebasing' the penny, by changing the value of it from one cent to five cents. Hoarders are already stockpiling pennies as a speculation. If this proposal goes through, that would be a pretty substantial return on a one cent investment.

Tuesday, January 23, 2007

Large US Companies Expanding into Bangalore

Hewlett-Packard (HPQ), Dell (DELL), IBM (IBM), Accenture (ACN), Intel (INTC) and over 500 large international corporations have set up operations in Bangalore, India.

Bill Gates, Michael Dell, Larry Page, Sergey Brin, Claudia Schiffer and Bono Meeting in Switzerland

Bill Gates founder of Microsoft (MSFT), Michael Dell founder of Dell (DELL), Larry Page and Sergey Brin founders of Google (GOOG), Claudia Schiffer and Bono are just a few of the famous who are meeting in Davos, Switzerland at the World Economic Forum 2007 from January 24 to January 28. The purpose of the forum is to "contribute towards solving the problems of our age".

Unilever in Trouble for Sending Knives to Families

Unilever NV (traded on the New York Stock Exchange under the symbol UN), the consumer goods and personal products company which is traded on the New York Stock Exchange, got into trouble for sending out knives to 200,000 homes in the Netherlands, since many children were hurt from the knives in the package.

Coal Stocks Heating up in the Last Few Days

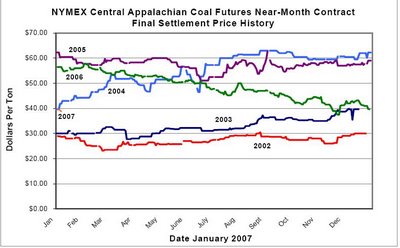

In case you didn't notice, every major coal stock, except one, was up significantly today, January 23, and some some of them were up as much as 3%. Not bad for a one day move. They have all started to move up in the last few days. Some are attributing this to the cold weather. But it is most likely more than that. In a previous article, I discussed the use of coal by electric utilities. With more than 70% of all utilities using coal to run their generators to produce electricity, the demand for coal is significant. The following is a list of the major coal stocks. Fording Canadian Coal Trust (FDG) is excluded from the list because it is a Canadian trust that I will be covering in an upcoming article on publicly traded trusts. You will notice that coal producers are not really high dividend payers [with the exception of Yanzhou Coal Mining and Fording Canadian Coal Trust], but I have included the yields for your review. If the current PE is not listed, it means recent earnings are negative.

Arch Coal Inc. (ACI) mines, processes, and markets bituminous and sub-bituminous coal with low sulfur content. PE=24. Yield .8%

CONSOL Energy Inc. (CNX) mines and markets steam coal. PE=17. Yield .8%

Foundation Coal Holdings Inc. (FCL) extracts, cleans, and sells coal to electric utilities, steel producers, and other industrial companies. PE=18. Yield .6%

International Coal Group, Inc. (ICO) produces, processes, and sells steam and metallurgical coal. No dividend.

James River Coal Co. (JRCC) mines, processes, and sells bituminous, steam, and industrial-grade coal. No dividend.

Massey Energy Co. (MEE) produces, processes, and sells steam and metallurgical grade bituminous coal. Yield .7%

National Coal Corp. (NCOC) mines, processes, and sells bituminous steam coal. No dividend.

Peabody Energy Corp. (BTU) has ownership interests in 36 coal operations. PE=19. Yield .6%

Westmoreland Coal Co. (WLB) produces and sells coal from surface mines to electric utilities. PE=38. No dividend.

Yanzhou Coal Mining Co. Ltd. (YZC) This Chinese company mines, and sells coal in China and Australia. PE=14. Yield 2.8%.

Author does not own any of the above.

Arch Coal Inc. (ACI) mines, processes, and markets bituminous and sub-bituminous coal with low sulfur content. PE=24. Yield .8%

CONSOL Energy Inc. (CNX) mines and markets steam coal. PE=17. Yield .8%

Foundation Coal Holdings Inc. (FCL) extracts, cleans, and sells coal to electric utilities, steel producers, and other industrial companies. PE=18. Yield .6%

International Coal Group, Inc. (ICO) produces, processes, and sells steam and metallurgical coal. No dividend.

James River Coal Co. (JRCC) mines, processes, and sells bituminous, steam, and industrial-grade coal. No dividend.

Massey Energy Co. (MEE) produces, processes, and sells steam and metallurgical grade bituminous coal. Yield .7%

National Coal Corp. (NCOC) mines, processes, and sells bituminous steam coal. No dividend.

Peabody Energy Corp. (BTU) has ownership interests in 36 coal operations. PE=19. Yield .6%

Westmoreland Coal Co. (WLB) produces and sells coal from surface mines to electric utilities. PE=38. No dividend.

Yanzhou Coal Mining Co. Ltd. (YZC) This Chinese company mines, and sells coal in China and Australia. PE=14. Yield 2.8%.

Author does not own any of the above.

Is Your Portfolio Ready for Vista? Is Your Computer?

Many investors believe that the release of the Vista Operating System should help the Microsoft (MSFT) stock. In addition, some investors believe that the retailers of computers, such as Dell (DELL) and Hewlett-Packard Co. (HPQ), are the better buy because businesses and individuals will have to upgrade their computers in order to run Vista.

But the question remains, are you ready for Vista? The easiest way to check is to go to the Windows Vista Upgrade Advisor which will have you download a program to determine whether your computer can run Vista and will provide a report of all known system, device, and program compatibility issues.

Author owns MSFT.

But the question remains, are you ready for Vista? The easiest way to check is to go to the Windows Vista Upgrade Advisor which will have you download a program to determine whether your computer can run Vista and will provide a report of all known system, device, and program compatibility issues.

Author owns MSFT.

Monday, January 22, 2007

Puerto Rico Stocks: A Passport to Riches?

In a recent article on Yahoo about the new passport regulations, it discussed the benefit that Puerto Rico and the U.S. Virgin Islands would receive. In the past, visitors to the non-US Caribbean islands, Canada, and Mexico could travel with just an American Drivers License. However, beginning February 23, American travelers to those nations would require a U. S. passport in order to return to the United States. The Caribbean islands are anticipating economic devastation.

On the other hand, a boom is expected for the travel business and economy of the U.S. territories in the Caribbean, which include the Commonwealth of Puerto Rico and the United States Virgin Islands, consisting primarily of the islands of St. Thomas, St. John, and St. Croix. [Trivia: What is the only part of the United States where traffic drives on the left? U.S. Virgin Islands.] Because they are considered part of the United States, American tourists don't need a passport to travel in those locales.

So if the Puerto Rican economy benefits from the new Passport law, does that mean that the Puerto Rican stocks should benefit? Most of the publicly traded companies in Puerto are banks or bank holding companies which have the same risks that all United States banks have. There is also the "risk" of Puerto Rico becoming independent, which may not even be a risk at all. The economy on the island has been shaky since May of 2006, when they experienced the first partial shutdown of the government in Puerto Rico's history. But if you are willing to accept the risks, then here is a list of Puerto Rican stocks to review, most of which are traded on the New York Stock Exchange [NYSE stocks listed first].

First BanCorp (FBP) banking

Doral Financial Corp. (DRL) mortgage banking, banking, institutional securities, insurance

Oriental Financial Group Inc. (OFG) banking, insurance

R&G Financial Corporation (RGF) banking, mortgages

Santander Bancorp (SBP) banking, asset management, insurance

W Holding Co. Inc. (WHI) banking, insurance

Popular Inc. (BPOP) banking, leasing, insurance

Equus Gaming Co. (EQUUS.PK) thoroughbred racing

Margo Caribe Inc. (MRGO.PK) tropical plants and trees

On the other hand, a boom is expected for the travel business and economy of the U.S. territories in the Caribbean, which include the Commonwealth of Puerto Rico and the United States Virgin Islands, consisting primarily of the islands of St. Thomas, St. John, and St. Croix. [Trivia: What is the only part of the United States where traffic drives on the left? U.S. Virgin Islands.] Because they are considered part of the United States, American tourists don't need a passport to travel in those locales.

So if the Puerto Rican economy benefits from the new Passport law, does that mean that the Puerto Rican stocks should benefit? Most of the publicly traded companies in Puerto are banks or bank holding companies which have the same risks that all United States banks have. There is also the "risk" of Puerto Rico becoming independent, which may not even be a risk at all. The economy on the island has been shaky since May of 2006, when they experienced the first partial shutdown of the government in Puerto Rico's history. But if you are willing to accept the risks, then here is a list of Puerto Rican stocks to review, most of which are traded on the New York Stock Exchange [NYSE stocks listed first].

First BanCorp (FBP) banking

Doral Financial Corp. (DRL) mortgage banking, banking, institutional securities, insurance

Oriental Financial Group Inc. (OFG) banking, insurance

R&G Financial Corporation (RGF) banking, mortgages

Santander Bancorp (SBP) banking, asset management, insurance

W Holding Co. Inc. (WHI) banking, insurance

Popular Inc. (BPOP) banking, leasing, insurance

Equus Gaming Co. (EQUUS.PK) thoroughbred racing

Margo Caribe Inc. (MRGO.PK) tropical plants and trees

EU Law May Impair Online Sales

A proposed law may require British businesses who sell online to comply with the laws of all 27 member countries of the European Union.

Starbucks an Insult to Chinese Culture

Chinese protesters are trying to shut down the Starbucks (SBUX) restaurant in the China Palace Museum in Beijing's Forbidden City. Starbucks has been there since the year 2000.

Sexy Stocks

The adult entertainment industry is anywhere from a $10 billion to a $20 billion industry, depending what source you refer to. According to freespeechonline.org , the adult entertainment industry generated $12.6 billion in 2005, with the adult Internet businesses growing 150% since 2002.

There are several ways to play in this sexy industry. The most famous company in this arena is Playboy (PLA) which is involved in most aspects of the industry including video and DVD’s, television shows, documentaries, Internet entertainment, e-commerce sites, and numerous Playboy brand products. They also own the Spice brand of TV shows and products. Other companies allow you to invest in more targeted areas of the industry including gentlemen’s clubs, video producers, and television broadcasting. A couple of the stocks were up over 34% for the last half of last year.

Check out these hot stocks before investing because you don’t want to get screwed. It’s hard to know when to cock your gun and pull the trigger on these stocks since the prices of some of them have become engorged during the last six months. Let’s hope that the investors continue to get lucky and the bubble in these stocks hasn’t been pricked, otherwise they may go down with a bang.

Here is the hot stock list:

Playboy (PLA) This New York Stock Exchange company was founded by Hugh M. Hefner in 1953 in Chicago Illinois with a $600 loan. Playboy Corporation grew to become the largest adult entertainment conglomerate in the world, with divisions covering magazines, clubs, clothing, web sites, television channels, and videos. It has a forward P/E of 23 and a Price/Sales Ratio of 1.13. The company is run by Christie Hefner, daughter of Hugh. The stock was up over 14% for the last six months of 2006.

New Frontier Media (NOOF) This Boulder, Colorado based company, traded on NASDAQ, provides adult entertainment TV networks, cable television video-on-demand, satellite broadcasts, motion pictures and hotel room broadcasts. It has a forward P/E of 17 and a Price/Sales Ratio of 4.2. The stock was up over 34% for the last half of 2006.

LodgeNet Entertainment (LNET) This NASDAQ traded Sioux Falls, South Dakota company provides television broadcasts to hotels in the U.S. and internationally, including on-demand movies which include mature audience entertainment. It has a forward P/E of 143 and a P/S of 1.6. The stock was up over 34% for the last half of 2006.

Private Media Group (PRVT) This adult media company is based in Barcelona, Spain. The company, which was founded in 1980, produces magazines, videos, DVD’s and movies for broadcast television, cable, satellite, and the Internet. The stock has a very high P/E of 140 and a P/S of 5.

Rick's Cabaret International (RICK) This Houston based company operates adult nightclubs in cities throughout the United States including Houston, New York, New Orleans, Charlotte, and Minneapolis. P/E is 22 and Price Sales is 1.65.

Million Dollar Saloon Inc. (MLDS.PK) Operates an adult cabaret in Dallas, Texas. The company was founded in 1982.

Scores Holding Co. Inc. (SCRH.OB) This New York City based company licenses its trademark to adult oriented nightclubs. P/E of 1.88 and a P/S of .9.

Interactive Brand Development Inc. (IBDI.OB) The company, based in Deerfield Beach, Florida, provides online payment processing services for adult entertainment companies. They also own a part interest in Penthouse Media Group, and an adult TV network.

Author owns RICK.

There are several ways to play in this sexy industry. The most famous company in this arena is Playboy (PLA) which is involved in most aspects of the industry including video and DVD’s, television shows, documentaries, Internet entertainment, e-commerce sites, and numerous Playboy brand products. They also own the Spice brand of TV shows and products. Other companies allow you to invest in more targeted areas of the industry including gentlemen’s clubs, video producers, and television broadcasting. A couple of the stocks were up over 34% for the last half of last year.

Check out these hot stocks before investing because you don’t want to get screwed. It’s hard to know when to cock your gun and pull the trigger on these stocks since the prices of some of them have become engorged during the last six months. Let’s hope that the investors continue to get lucky and the bubble in these stocks hasn’t been pricked, otherwise they may go down with a bang.

Here is the hot stock list:

Playboy (PLA) This New York Stock Exchange company was founded by Hugh M. Hefner in 1953 in Chicago Illinois with a $600 loan. Playboy Corporation grew to become the largest adult entertainment conglomerate in the world, with divisions covering magazines, clubs, clothing, web sites, television channels, and videos. It has a forward P/E of 23 and a Price/Sales Ratio of 1.13. The company is run by Christie Hefner, daughter of Hugh. The stock was up over 14% for the last six months of 2006.

New Frontier Media (NOOF) This Boulder, Colorado based company, traded on NASDAQ, provides adult entertainment TV networks, cable television video-on-demand, satellite broadcasts, motion pictures and hotel room broadcasts. It has a forward P/E of 17 and a Price/Sales Ratio of 4.2. The stock was up over 34% for the last half of 2006.

LodgeNet Entertainment (LNET) This NASDAQ traded Sioux Falls, South Dakota company provides television broadcasts to hotels in the U.S. and internationally, including on-demand movies which include mature audience entertainment. It has a forward P/E of 143 and a P/S of 1.6. The stock was up over 34% for the last half of 2006.

Private Media Group (PRVT) This adult media company is based in Barcelona, Spain. The company, which was founded in 1980, produces magazines, videos, DVD’s and movies for broadcast television, cable, satellite, and the Internet. The stock has a very high P/E of 140 and a P/S of 5.

Rick's Cabaret International (RICK) This Houston based company operates adult nightclubs in cities throughout the United States including Houston, New York, New Orleans, Charlotte, and Minneapolis. P/E is 22 and Price Sales is 1.65.

Million Dollar Saloon Inc. (MLDS.PK) Operates an adult cabaret in Dallas, Texas. The company was founded in 1982.

Scores Holding Co. Inc. (SCRH.OB) This New York City based company licenses its trademark to adult oriented nightclubs. P/E of 1.88 and a P/S of .9.

Interactive Brand Development Inc. (IBDI.OB) The company, based in Deerfield Beach, Florida, provides online payment processing services for adult entertainment companies. They also own a part interest in Penthouse Media Group, and an adult TV network.

Author owns RICK.

Friday, January 19, 2007

Inflation Proof Postage Stamps: An Investment?

This spring, the United States Postal Service is planning on releasing what it is calling Forever Stamps, which are inflation proof postage stamps that can be used anytime forever for first class one ounce postage, even if rates go up to $1 per ounce or $10 per ounce. So whether you are a small business that does a lot of mass mailouts, a consumer who pays a lot of bills by mail, or even an autograph collector who sends out stamped self addressed envelopes to movie stars and worries about getting a response a year later after rates have gone up and the envelope being returned to the actors, these stamps could be for you. Now if the post office would offer a similar type of postage for bulk rate Forever postal permits, that would be a boon to large businesses.

Notable Business Quotes

Emily Brown Bloomberg.com released the Notable Business Quotes for the week. I especially liked:

``The tepid forecasts spooked people.''

Portfolio manager Warren Simpson at Stephens Capital Management

``They are in the sweet spot of the economy.''

Roger Kubarych, chief U.S. economist at Unicredit HVB

``The tepid forecasts spooked people.''

Portfolio manager Warren Simpson at Stephens Capital Management

``They are in the sweet spot of the economy.''

Roger Kubarych, chief U.S. economist at Unicredit HVB

Flywheel Stocks: An Obscure Alternative Energy

I’ve covered several types of alternative energy stocks in previous articles, including solar energy stocks, wind energy stocks, and ethanol stocks. Today, I’m covering a fairly obscure type of alternative energy called flywheel storage energy. Flywheels are rotating disks that are used to store kinetic energy. Flywheels have recently become popular in the Uninterruptible Power Supply (UPS) business for short term power outages and research has been done into its use for automobiles. There are several advantages to the flywheel technology over the lead-acid batteries in UPS’s, including higher efficiency, a longer lifespan, and a smaller size, not to mention the reduction in safety and disposal issues that exist with the lead-acid battery UPS's.

The universe of flywheel stocks is small, with only two publicly traded companies, both of which trade on NASDAQ. The older of the two companies is Active Power Inc. (ACPW) which was founded in 1992 and is based in Austin, Texas. They manufacture and sell power products that are battery free such as their CleanSource UPS, a battery-free uninterruptible power supply utilizing flywheel technology. The company is debt free with year-over-year quarterly revenue growth of 27%.

Beacon Power Corp. (BCON) was founded in 1997 and is based in Wilmington, Massachusetts. Their primary product is Smart Energy matrix, a flywheel-based energy storage system used by electrical utilities for electric grid regulation. This company is also debt-free but has a 9% year-over-year revenue reduction.

Author does not own either of the above.

Plenty of Foreclosures Available for Real Estate Investors

If you are thinking of investing in real estate and you thing the real estate market is near a bottom, there are plenty of opportunities available for you, either on a pre-foreclosure basis (where you buy the property from the owner before it goes into foreclosure), auctions, and bank owned properties (also known as REO's or Real Estate Owned properties).

Fortunately for the investor (and unfortunately for the homeowners), there are thousands and thousands of properties that are available in these categories. At RealtyTrac.com, they provide an outstanding service which allows you to search by city or zip code, and find all the available properties broken down by the various categories (pre-foreclosures, auctions, etc.). Then for every property, it lists the address and the number of bedrooms and bathrooms, and when you click on the property you are interested in, it shows square footage, lot size, year built, a map showing where the property is, history of notices, estimated property value range, estimated property market value, and much, much more.

One of this nice features about this website is that it can give you an idea of how foreclosures are trending across the country and from city to city. For example, even though Los Angeles is a far bigger city than San Diego, San Diego has more bank owned properties for sale than LA. Chicago has 13,529 pre-foreclosure properties for sale whereas Houston has only 3. However, Houston has many more bank owned properties (5,513) than Chicago (4,164). (Maybe Texas is much more strict on how long a property can stay in pre-foreclosure?) Boston's auctions and bank owned properties were extremely low compared to the other major cities.

The following table should give you a good idea of the number of foreclosures across the United States.

City..........Pre-Foreclosure...Auction..........Bank Owned

San Diego.........1,709..............339..............1,174

Los Angeles......2,494..............442..............1,107

Houston................3............1,933..............5,513

Memphis............289............2,007..............3,540

Miami..............6,316............1,804..............2,313

Boston...............566...............64................171

Chicago.........13,529............4,633..............4,164

Fortunately for the investor (and unfortunately for the homeowners), there are thousands and thousands of properties that are available in these categories. At RealtyTrac.com, they provide an outstanding service which allows you to search by city or zip code, and find all the available properties broken down by the various categories (pre-foreclosures, auctions, etc.). Then for every property, it lists the address and the number of bedrooms and bathrooms, and when you click on the property you are interested in, it shows square footage, lot size, year built, a map showing where the property is, history of notices, estimated property value range, estimated property market value, and much, much more.

One of this nice features about this website is that it can give you an idea of how foreclosures are trending across the country and from city to city. For example, even though Los Angeles is a far bigger city than San Diego, San Diego has more bank owned properties for sale than LA. Chicago has 13,529 pre-foreclosure properties for sale whereas Houston has only 3. However, Houston has many more bank owned properties (5,513) than Chicago (4,164). (Maybe Texas is much more strict on how long a property can stay in pre-foreclosure?) Boston's auctions and bank owned properties were extremely low compared to the other major cities.

The following table should give you a good idea of the number of foreclosures across the United States.

City..........Pre-Foreclosure...Auction..........Bank Owned

San Diego.........1,709..............339..............1,174

Los Angeles......2,494..............442..............1,107

Houston................3............1,933..............5,513

Memphis............289............2,007..............3,540

Miami..............6,316............1,804..............2,313

Boston...............566...............64................171

Chicago.........13,529............4,633..............4,164

Thursday, January 18, 2007

Lucent Closed at over $1000 per Share Today

Yes, you read that right. Lucent, the voice, data, and video communication services company, closed at $1,037.50 per share Thursday, January 18. You didn't think this was the Lucent common stock that used to trade on the NYSE under the symbol LU, nor is it the Alcatel-Lucent (ALU) stock which is the result of the merger between French communications company Alcatel with Lucent. Of course, I'm talking about Lucent's preferred stock, with the official name of Lucent Technologies Capital Trust I (LUTHP.OB). This is a 7.75% Cumulative Convertible Trust Preferred Security which was first issued in 2002. During the last year, it had a low of 935.00 and a high of 1,100.00.

Tuesday, January 16, 2007

Best Selling Investment Books according to Amazon

Stocks Category

Jim Cramer's Real Money: Sane Investing in an Insane World

by Jim Cramer

The Essays of Warren Buffett : Lessons for Corporate America

by Warren E. Buffett, Lawrence A. Cunningham

The Little Book That Beats the Market

by Joel Greenblatt

The Neatest Little Guide to Stock Market Investing (Revised Edition) (Neatest Little Guide to Stock Market Investing)

by Jason Kelly

The Second Great Depression

by Warren Brussee

Real Estate Category

The Wall Street Journal. Complete Real-Estate Investing Guidebook

by David Crook

Rich Dad's Advisors®: The ABC's of Real Estate Investing: The Secrets of Finding Hidden Profits Most Investors Miss (Rich Dad's Advisors)

by Ken McElroy

Rich Dad's Real Estate Advantages: Tax and Legal Secrets of Successful Real Estate Investors

by Sharon L. Lechter, Garrett Sutton

Find It, Fix It, Flip It!: Make Millions in Real Estate--One House at a Time

by Michael Corbett

The Pre-Foreclosure Property Investor's Kit: How to Make Money Buying Distressed Real Estate -- Before the Public Auction

by Thomas Lucier

Jim Cramer's Real Money: Sane Investing in an Insane World

by Jim Cramer

The Essays of Warren Buffett : Lessons for Corporate America

by Warren E. Buffett, Lawrence A. Cunningham

The Little Book That Beats the Market

by Joel Greenblatt

The Neatest Little Guide to Stock Market Investing (Revised Edition) (Neatest Little Guide to Stock Market Investing)

by Jason Kelly

The Second Great Depression

by Warren Brussee

Real Estate Category

The Wall Street Journal. Complete Real-Estate Investing Guidebook

by David Crook

Rich Dad's Advisors®: The ABC's of Real Estate Investing: The Secrets of Finding Hidden Profits Most Investors Miss (Rich Dad's Advisors)

by Ken McElroy

Rich Dad's Real Estate Advantages: Tax and Legal Secrets of Successful Real Estate Investors

by Sharon L. Lechter, Garrett Sutton

Find It, Fix It, Flip It!: Make Millions in Real Estate--One House at a Time

by Michael Corbett

The Pre-Foreclosure Property Investor's Kit: How to Make Money Buying Distressed Real Estate -- Before the Public Auction

by Thomas Lucier

Cigarette Stocks are Smokin'

But are they good for your financial health? Last year, all the major tobacco companies were up, and a couple of them, Gallaher Group plc (GLH) and Carolina Group (CG), were up over 50% for the year. In addition, all the big cigs pay dividends of over 2%. Here is the list sorted by highest yield first: